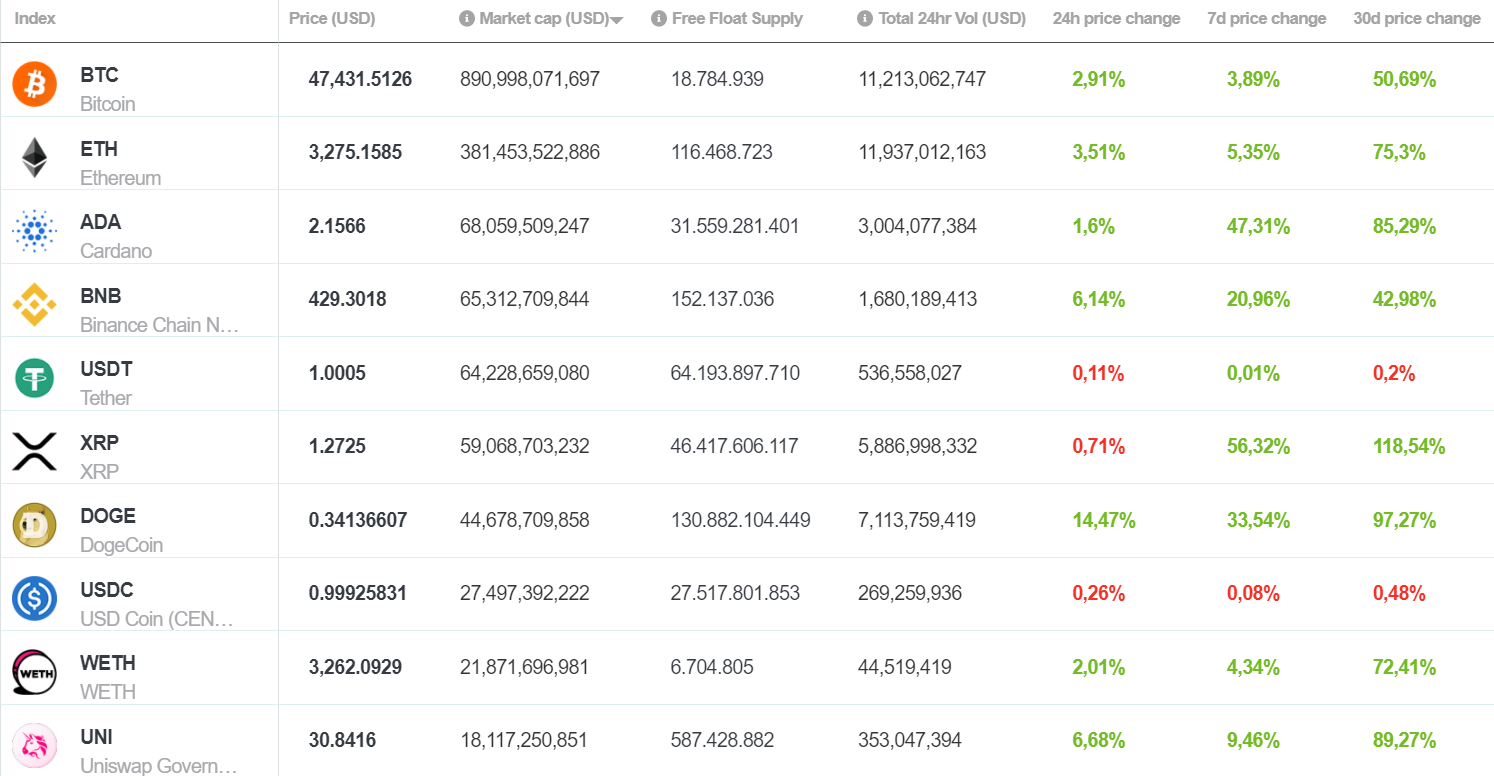

We had another strong week in the cryptocurrency market, with significant gains for large and mid-cap assets.

Bitcoin (BTC) and Ethereum (ETH), the two largest assets on Brave New Coin’s (BNC) market capitalization table, were up 10% and 14%, respectively.

These gains were overshadowed by the even stronger performance of large cap assets such as Cardano (ADA) and XRP, which grew 52% and 66%.

Bitcoin scenario in recent months

In June of this year, the crypto market took a heavy toll, resulting from the “fear, uncertainty and doubt” – FUD – related to the ban on mining activities in China and the environmental concerns of Elon Musk, CEO of Tesla Motors

Now these concerns are in the past and the market continues to recover.

Bitcoin is a bit far from reaching a new record high. However, a new milestone is the capitalization carried out by bitcoin, which reached a new record high last Friday, August 13th.

📈 #Bitcoin $BTC Realized Cap just reached an ATH of $378,768,190,450.72

View metric:https://t.co/C8JhD26mC1 pic.twitter.com/ohXnmFDkNk

— glassnode alerts (@glassnodealerts) August 14, 2021

According to Glassnode, a realized cap is an alternative measurement to a traditional market cap that assesses the value of a “stored” or “saved” blockchain asset based on the price when the currency was last moved.

Realized cap hit a new record high, meaning more money is being invested in bitcoin now than in April, when the cryptocurrency price was $64,000.

This metric suggests that, since April, there has been a willingness by new buyers to buy bitcoin at higher price levels, despite negative market sentiment.

The price of Bitcoin and the cryptocurrency market continues to rise

The network is more resilient than it was in May, the rate of hashes — the computing power used to mine new blocks — has been steadily rising since early June, and bitcoin miners are increasingly looking for solutions to manage the impact environmental impact of cryptocurrency mining.

The price of bitcoin and the cryptocurrency market continues to rise in August, despite the advance of strict crypto regulation in a large US infrastructure project and large fines paid to US regulators by crypto brokers Poloniex and BitMEX.

Scenario for Cardano

Last week, Cardano had become the third-largest cryptoactive on the market.

There was positive sentiment following confirmation that autonomous contracts will be implemented on the network as part of the hard fork Alonzo, which is scheduled to launch on September 12th.

After years of waiting, the network will allow decentralized applications (dapps) to be launched using Plutus, the network’s unique and proprietary programming language.

The proof-of-stake (PoS) blockchain — which relies on user participation, not mining — will expand its usefulness and allow users to access DeFi, gaming, and non-fungible tokens (NFTs) industry applications.

Busy week at the cryptocurrency market

It was a strong trading week for the big cryptoactives on the BNC capitalization table. Many had double-digit gains. XRP soared, rising more than 60%

However, analysts warned about the asset’s trading. Technical trading indicators such as the Relative Strength Index (RSI) and Bollinger bands suggest that the asset is overbought.

There were concerns when a large amount of XRP was moved to a brokerage as it suggests an intention to sell or liquidate

Top 10 cryptocurrencies of the week: summary

1 – Bitcoin: A point-to-point digital currency, which means that every transaction takes place directly between equal and independent parties, without the need for any intermediary to allow or facilitate.

Bitcoin was created, in Nakamoto’s own words, to allow “online payments to be sent directly from one party to another, without going through a financial institution”.

2 – Ethereum: A decentralized and open-source blockchain system, which has its own cryptocurrency, the Ether. ETH serves as a platform for several other cryptocurrencies, as well as for executing decentralized smart contracts.

Ethereum’s very purpose is to become a global platform for decentralized applications, enabling users around the world to write and run software that is resistant to censorship, downtime and fraud.

3 – Cardano: A proof-of-stake blockchain platform that claims to be aimed at enabling “changemakers, innovators and visionaries” to bring about positive global change.

The open-source project also aims to “redistribute the power of complex structures to the margins of the individual” — helping to create a safer, more transparent and just society.

4 – Binance Coin: Also called BNB, it can be used as a payment method, a utility token to pay fees at Binance brokerage and to participate in token sales on Binance releases. The BNB also feeds Binance DEX (decentralized brokerage).

5 – Tether: Known as USDT, Tether is a digital currency created to mirror the value of the US dollar. Launched in 2014, the idea behind Tether was to create a stable cryptocurrency that could be used like a digital dollar, or “stablecoin.” Tethers is anchored, or “tethered,” at the price of the US dollar.

6 – XRP: The currency executed on the digital payment platform called RippleNet, which is part of the distributed database ledger called XRP Ledger.

7 – Dogecoin: DOGE, as it is called, is based on the popular internet meme the “doge” and has a Shiba Inu logo. Dogecoin’s creators envisioned it as a fun, laid-back cryptocurrency that would have greater appeal beyond Bitcoin’s target audience.

8 – USD Coin: Known by its ticker USDC, it is a stablecoin pegged to the US dollar at a rate of 1:1. Each unit of this cryptocurrency in circulation is backed by $1 held in reserve, in a mix of cash and short-term US Treasury bonds.

9 – WETH: A cryptocurrency and operates on the Ethereum platform. W-ETH is the “wrapped ETH”. When a dApp (decentralized application) is built from the Ethereum Blockchain, it usually implements its own form of token.

10 – Uniswap: A popular decentralized trading protocol known for its role in facilitating automated trading of decentralized finance tokens (DeFi).

Uniswap aims to keep token trading automated and completely open for anyone with tokens, while improving trading efficiency compared to traditional exchanges.

Back to Bitcoin: price graph

Bitcoin markets had a strong midweek, with a spike above the $48,000 price level.

Bitcoin continues its strong medium-term trend, rising 50% in the last month.

Glassnode said investors are in accumulation mode as bitcoin exited brokerages in August at a rate of between $75,000 and $100,000 a month.

#Bitcoin has continued to flow out of exchanges in August at a rate between 75k and 100k per month.

This magnitude of outflow is similar to the period between 2020 and Q1 2021, where heavy accumulation, and the GBTC arbitrage trade dominated.

Live Chart https://t.co/q9xOEQdXk4 pic.twitter.com/UHF6oqhRPL

— glassnode (@glassnode) August 12, 2021

Historically, this pattern of bitcoin flow from brokers to private portfolios is positive, as it suggests that less bitcoin is being sold and more bitcoin is being stored.