With the drop in the price of BTC recently, many experts have expressed their views on whether the BTC bull run is over. Scholars are divided evenly into bull and bear fields, each field with a different logic sounding just as convincing as the next. This left many traders confused and uncertain about the direction of the BTC price.

The way out of this confusion is to analyze the data in chains, as they can never lie. A set of data in the chain seems to suggest that this could just be a mid-cycle redistribution of BTC supply from weak hands to strong hands, rather than an end to the market’s uptrend.

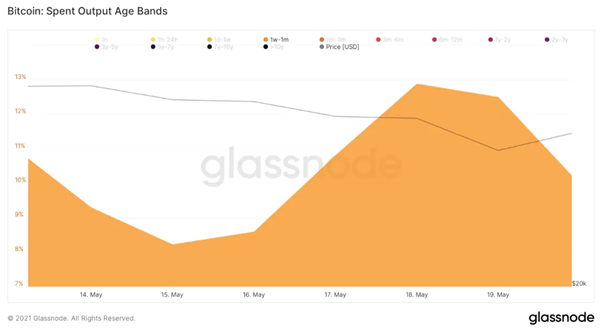

During the recent decline, new hands were seen as the top sellers of BTC, with the biggest increase in selling coming from one week to one month old coins, suggesting that new buyers with a 1 week to 1 month retention period were the biggest sellers. This group of sellers accounted for about 13% of all BTC sellers during liquidation week.

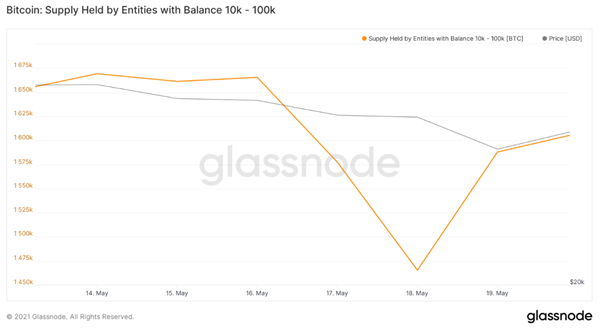

Reports further indicate that BTC whales with between 10,000 and 100,000 BTC bought 122,588 BTC en masse over the week, the price of BTC started to drop below $35,000, absorbing most of the sales by these news hands entering the market. waiting for a quick hit. These buyers were old, strong hands that had never sold their BTC for at least 3 years, indicating that the BTC offer is being shifted from new weak hands to strong, experienced hands.

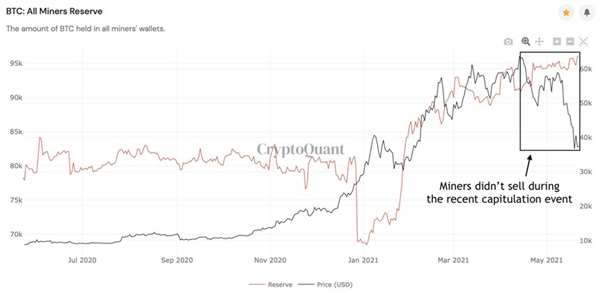

A check on the miners’ BTC reserve also showed that the miners were not involved in the sale and, in fact, could even be building up during the sale, causing their reserves to increase during this period.

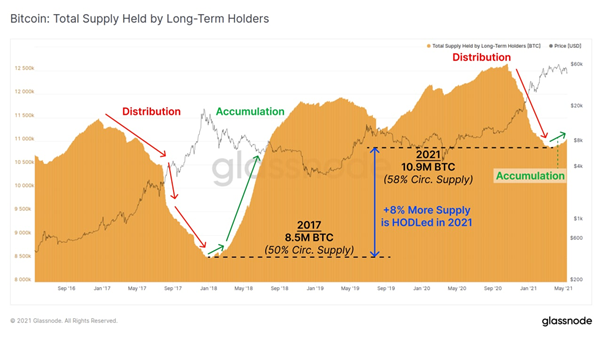

Since the liquidation, the supply of BTC held by long-term BTC holders has increased, while that of short-term speculators has declined. With long-term holders back in accumulation mode, it bodes well for the price of BTC as we go forward, as supply distribution is usually not indicative of a market top. At the top of the market, long-term holders will be seen to reduce their offer intensely, while new hands will be seen piling up. In the last sale, it was the opposite. Long-term holders were piling up while new entrants were being phased out.

Looking at the chart above, we can see that when the 2017 bull market came to an end, long-term holders were aggressively selling, drastically reducing their BTC offer. However, it is observed that this group of investors is currently in accumulation mode. Between 2017 and now, an additional 2.4 million BTC, or 8% of the current supply, has been purchased by these long-term holders, further reducing the supply of BTC available for purchase and sale. This group of hodlers already owns 58% of the current supply of BTC, which means that the supply crisis will intensify even more as we move into the future as they continue to buy more.

After analyzing the various metrics, I am of the opinion that the bull market may not be over and we, in fact, may be entering the next parabolic stage of a price increase, as the accumulation of long-term holders will intensify the crisis. supply of the BTC. This supply crisis will likely go unnoticed until a later stage, when circulating supply dwindles to the point where it becomes difficult to acquire BTC. More institutional investors have shown interest in accumulating BTC and other cryptocurrencies, with names like Carl Icahn announcing that he would invest up to $1.5 billion in cryptocurrencies. Much of the BTC offering will therefore be downsized and taken out of circulation by this smart institutional money, leaving very little for the average investor.

With short-term speculators not owning much BTC right now, there is less pressure on the price as speculators don’t have more BTC to sell, while long-term holders are hoarding rather than selling. There might even be a good chance we’ll see these same short-term players come back FOMO-style to chase the BTC price when the price rises above $45,000, and even more so when the BTC exceeds its $64,000 ATH. When it breaks above $64,000, I expect the price of BTC to rise fast and furiously in a parabolic fashion, which could send the price of BTC to $100,000 and beyond, where I believe the next big pullback could happen.

About Kim Chua, Senior Market Analyst at PrimeXBT:

Kim Chua is an institutional trading specialist with a successful track record that spans major banks including Deutsche Bank, China Merchants Bank and others.

Over time, Chua launched a hedge fund that consistently delivered triple-digit returns for seven years. Chua is also an educator at heart who developed her own trading curriculum to pass her knowledge on to a new generation of analysts.

Kim Chua closely follows the traditional and cryptocurrency markets and is eager to find future investment and trading opportunities as the two very different asset classes begin to converge.