The NFT bubble is not popping, but it seems to have sprung a leak. Visitors take photos in front of historic sites and other places that interest them. In one case, Chinese contemporary artist Yang Yongliang took a photo in front of a video installation “Glows in the Night” which was converted into NFTs and then sold on Sotheby’s nonfungible token (NFT) marketplace on September 30, 2021.

The NFT bubble is not popping, but it seems to have sprung a leak. One year from when a single NFT sold for $69.3 million in cryptocurrency at Christie’s auction house, with the buyer paying to be recorded on blockchain as the sole owner of a digital file that anybody can see online for free, the weird and wild market appears to be showing some signs of slowing down.

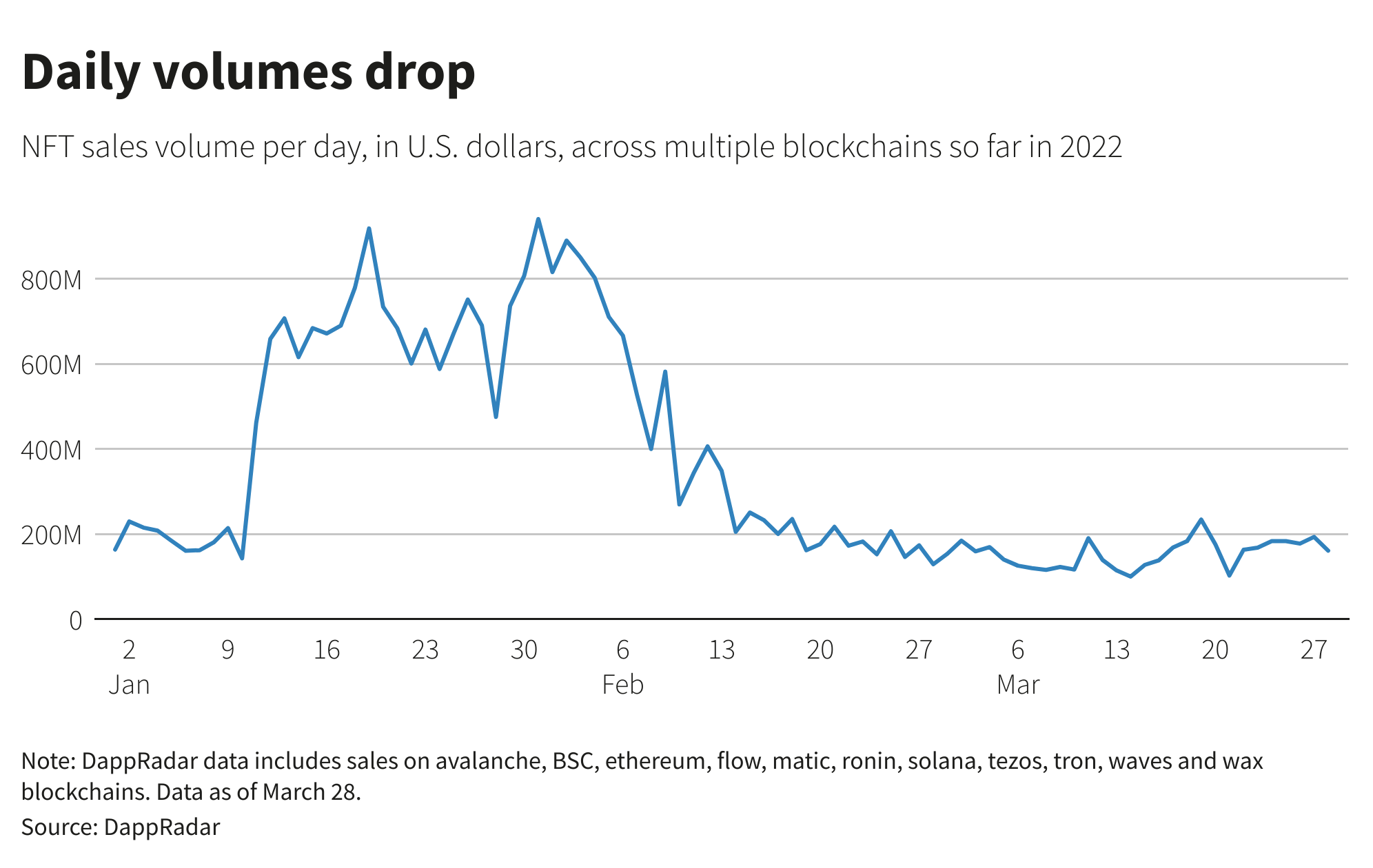

Sales on the biggest NFT marketplace, OpenSea, had surged to almost $5 billion in January, which was a massive surge from the $8 million recorded a year before. However, sales dropped to about $2.5 billion in March.

About 635,000 people acquired an NFT in March, for around $427 on average, based on the market tracker CryptoSlam, down from around 948,000 people who bought for an average of $659 in January. Nonetheless, firms continue to pile into the trendy ‘metaverse’ where various digital assets like clothing for avatars and virtual land can be acquired for crypto as NFT.

JPMorgan and HSBC are among the businesses that have already opened virtual venues in NFT-based worlds in 2022, while YouTube and Instagram also have confirmed that they have NFT plans. A Miami-based digital art collector, Pablo Rodriguez-Fraile, stated:

“Obviously the enthusiasm and interest that we had at some periods last year is not here anymore. I think we achieved something that wasn’t sustainable.”

But, he also stated that sales had picked up again in recent weeks.

NFT Sales On OpenSea

The director of finance and analytics at NFT research company DappRadar, Modesta Masoit, explained that the market was not in a general drop but rather it was consolidating after its explosive growth, adding that some investor caution after Russia’s invasion of Ukraine in late February might have depressed the sales. She mentioned:

“Everybody was expecting that there was going to be a consolidation period. It’s not going away, it’s just consolidating.”

The general NFT sales have reached $11.8 billion so far in 2022, based on DappRadar, excluding $19.3 billion worth of sales from a platform that is suspected to be dominated by irregular trades, where a few accounts trade items back and forth to inflate the prices.

From Bull To Bear To Ape

The nonfungible tokens can be exotic but dangerous at the same time. Prices can plunge steeply after an initial rise, in a highly volatile market where the value of an asset mostly depends on its social status. The head of digital assets at auction house Bonhams, Nima Sagharchi, explained that contrary to the traditional art world, the NFT market can balance between bull and bear cycles within even a week.

An NFT that represents a piece of computer-generated abstract images from a collection known as Art Blocks would sell for nearly $15,000 on average at a peak in September last year but barely fetched $4,200 in March 2022, according to CryptoSlam.

In the meantime, Bored Ape Yacht Club (BAYC) NFTs still sell for nearly $300,000 on average. BAYC NFT collection comprises a set of 10,000 variations on a cartoon primate.

Buying a Bored Ape, just like Paris Hilton and Madonna have done, can be considered similar to joining a cross between a member’s club and a trendy investment scheme. Buyers mostly advertise their membership by setting their NFT as the profile picture on social media.

Crypto known as ApeCoin was launched in March and offered initially to the holders of Bored Ape NFTs and the project’s founders. Coinbase data puts its market cap at over $3.4 billion.

A former Goldman Sachs executive, Raoul Pal, published in a blog post that expectations for the token encouraged him to spend nearly $400,000 worth of the crypto Ether on a Bored Ape NFT.

He wrote:

“Social tokens are the BIG thing.”