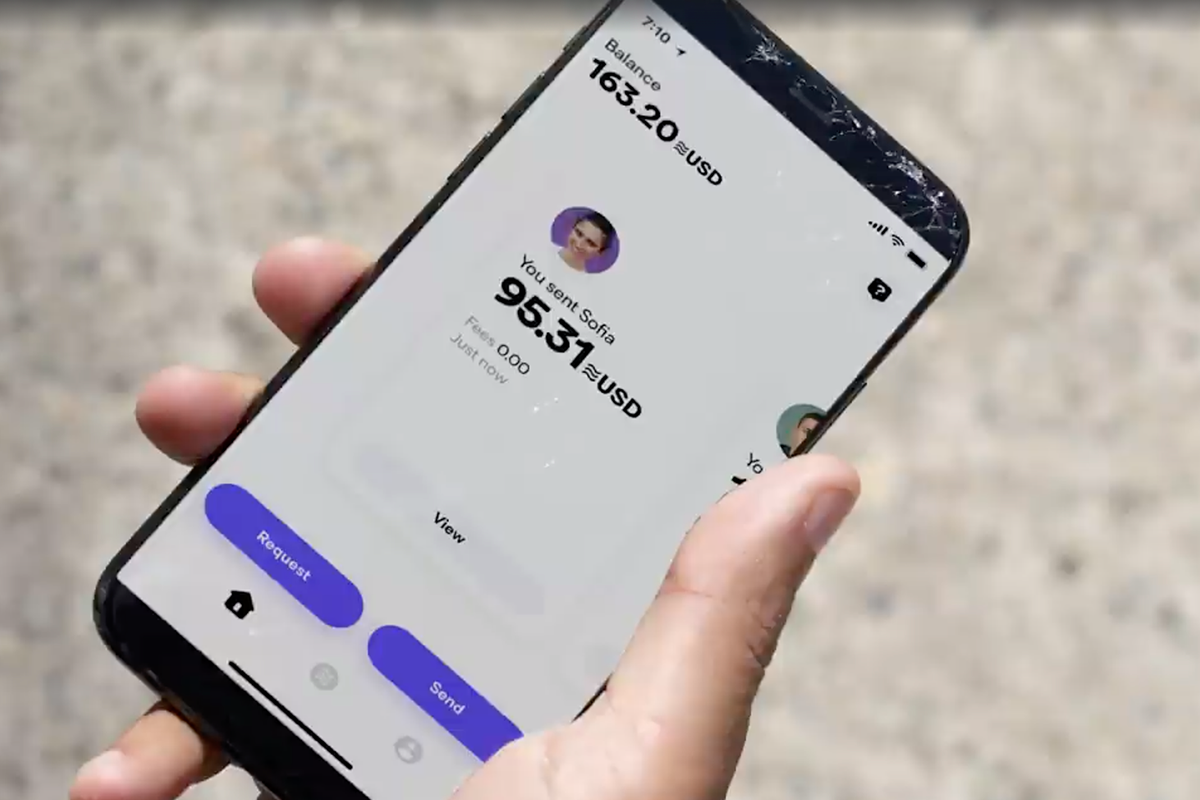

Novi, Facebook’s digital wallet, will be based on Diem’s blockchain, a cryptocurrency created by the social network.

Cryptocurrencies on Facebook? Meet Novi

Facebook’s mission “is to make the world more united”. However, increasingly this is not just about connecting friends and family to share messages, but also serving as a platform for people’s financial lives.

Facebook’s mission “is to make the world more united”. However, increasingly this is not just about connecting friends and family to share messages, but also serving as a platform for people’s financial lives.

Last year, the company made nearly $100 billion in payments.

However, the most recent bet of the famous social network is in its digital wallet, Novi, created for its users to move money quickly and cheaply – even for free, in many cases. The payment system will be based on Diem’s blockchain (DIEM), a cryptocurrency created by members who run Facebook’s financial services.

The Diem payment system will have the same currency value as the countries in which it will initially be supported: Dollar, Pound Sterling and Euro. “The goal is that, over time, the Diem payment system will be compatible with more digital currencies”, explains the Novi website.

There is still no forecast when Novi will hit the market, but the payment system has already achieved regulatory approval in almost every state in the United States.

The digital wallet will be available as a standalone app on the App Store and Google Play Store, and it will also be possible to use it directly in WhatsApp and Messenger apps.

The payments industry’s new competitor

On August 18, David Marcus, head of Facebook’s cryptocurrency sector, used his Twitter profile to talk about the new payments system:

“A lot has been said about stablecoins, payments, and Facebook and Novi’s potential role to improve what I see as an unacceptable status quo of our payment systems that still leaves many people behind”. He also indicated the reading of his article published on Medium.

A lot has been said about stablecoins, payments, and Facebook and Novi’s potential role to improve what I see as an unacceptable status quo of our payment systems that still leave too many people behind. Here’s my take: https://t.co/MPva0LOcGN

— David Marcus (@davidmarcus) August 18, 2021

On Medium, Marcus cites Novi as “the payments industry’s new competitor”. In addition, he says that the digital wallet, which has been built for more than two years, was designed for people and possibly small businesses to move money, nationally and internationally, in a fast and accessible way.

According to him, the current “payments infrastructure is broken” and the covid-19 pandemic reinforced the need for changes to a system that ensures more agility and inclusion.

“The systems that exist today are expensive, slow, and not interconnected. There are currently around 1.7 billion unbanked people worldwide. Among them are 62 million Americans who don’t have banks – people left behind by the current system and trapped in the money economy”, he said.

Marcus explains that the idea is to make Novi include these people in the system. He compares the service to WhatsApp and Messenger, showing that just as these products helped “billions of people communicate for a fraction of the cost these consumers paid before these apps existed”, Novi intends to do the same.

Is Novi safe?

The Facebook problem

Recounting some of Facebook’s setbacks in trying to break into the cryptocurrency payments industry, Marcus describes the tech giant, subject to antitrust investigations around the world, as a very disadvantaged company.

“We face unfair resistance in the financial sector”, he wrote. “I’ve heard a lot of talk about how this [Novi] proposal would be great if Facebook weren’t involved. I understand and accept the need for a thorough examination in front of our scale”.

However, Marcus describes his company as a “competitor in the payments industry” with no specific plan to monetize the use of the Novi digital wallet, which will not charge for person-to-person payments, even across borders.

Marcus also said that by allowing users to pay with dollars, euros and other legal tender currencies, the Novi digital wallet will further increase its value. However, he says that before doing so, the company doesn’t want to miss the chance to incorporate stablecoins into an “open, interoperable protocol” for online payments. “Having maximum impact, creating a closed system, using legal tender coins is not enough for us to be successful”, he said in his memo.

What do cryptocurrency enthusiasts say?

Cryptocurrency advocates claim that blockchain technology allows for products that eliminate middlemen, credit analysis and commissions. In addition, the technology allows people excluded from traditional financial services to transact anytime, anywhere.

According to Marcus, a well-designed stablecoin, pegged to a legal tender and backed by cash reserves, can offer strong consumer protections. Also, access to funds would be easier than traditional bank accounts.

What do regulators say?

In practice, many regulators have been wary of stablecoins.

An investigation of the popular Tether (USDT) digital currency, conducted by the New York Attorney General, concluded that the company has coined unreserved tokens to back it up. In recent weeks, crypto-tokens have raised concerns on the part of Treasury Secretary Janet Yellen, SEC chairman Gary Gensler and Senator Elizabeth Warren of Massachusetts.

Marcus tried to allay such concerns. According to him, Diem will continue to persevere and demonstrate that it can be a reliable competitor in this sector, noting that the Novi digital wallet has licenses or approvals in almost every American state and the Diem project resolved all legitimate concerns in this regard.

Marcus ends by stating that Facebook’s digital wallet is ready to enter the market, and it “serves a fair chance”.