Index

● Explanation of New Accounts Denoted in COV

● New VOC-Denominated Accounts Are Already Active

We are proud to reveal that our close partner Covesting is moving forward with the latest milestone in their product roadmap and has delivered yet another valuable addition to the many features the COV token provides.

Last year, together, we enabled a COV wallet that can be used to activate Advanced, Premium and Elite account memberships, each with a multitude of COV token utilities that can be activated. Utilities include increased profit sharing, improved follower limits, trading fee discounts, and more.

Today we are pleased to introduce Covesting’s latest update: the launch of COV-denominated Margin Trading Accounts and Covesting Copy Trading Strategy Manager Accounts. This means that the Covesting community can now use their COV tokens to trade the full range of world-class trading instruments without having to first exchange COV for BTC, ETH or another asset.

Explanation of the New Accounts Denominated in COV

To help the Covesting community take advantage of these new COV account types, we’ve prepared the guides below, along with more details on the benefits they offer.

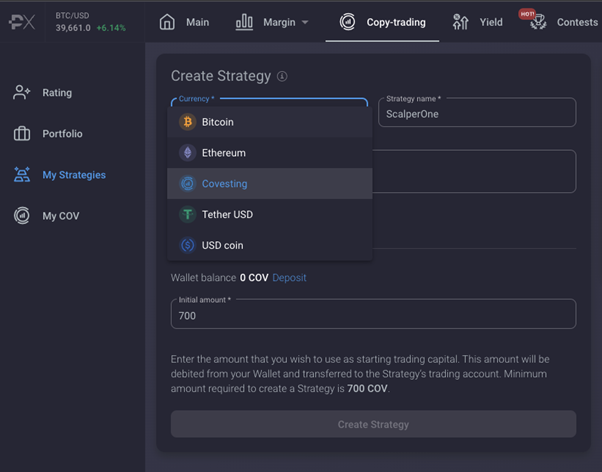

The COV Named Strategy Manager Account Walkthrough

Creating a strategy manager account named COV is as easy as setting up an account with any other asset.

● Step 1: Simply visit the copy trading section of PrimeXBT and click on “Get Started” in the My Strategies tab.

● Step 2: Next, choose COV as the currency and fill in the rest of the strategy-related information.

● Step 3: Start trading and gaining followers.

In a future roadmap update, strategy managers will get a 25% revenue share of all profits generated for followers compared to the standard 20% regardless of membership level. The planned increase in revenue share can increase profitability for skilled strategy managers.

Followers can also follow strategies named COV using COV token. A future roadmap update will allow those who leverage and follow so-called VOC strategies to benefit from the maximum 75% profit share instead of the standard 65%.

These exciting roadmap updates and other improvements to Covesting’s COV token utility will be revealed in the coming months.

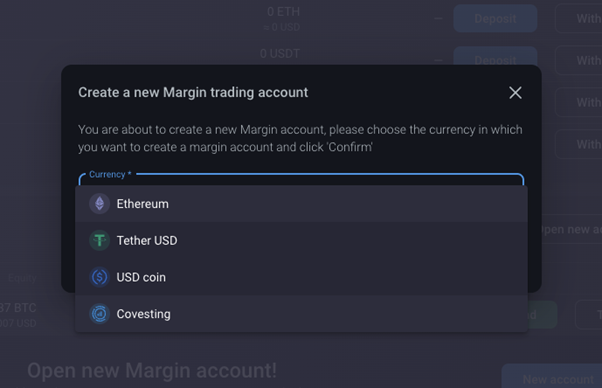

The Walkthrough Of The COV Denominated Margin Trading Account

PrimeXBT users can now also use COV tokens as collateral to fund a margin trading account, just like you can with BTC, ETH, USDT and USDC. COV tokens provide PrimeXBT users with yet another alternative asset for the greatest possible flexibility and to further support our partner Covesting’s development roadmap.

Setting up a margin trading account named COV is as easy as any other asset.

● Step 1: Select COV as the currency when creating a new margin trading account.

● Step 2: Move the COV from the wallet to fund the margin trading account.

● Step 3: Select a market and start trading.

Platform users can manage their positions by selecting the COV margin account specifically from the dropdown in the margin section.

New COV-Denominated Accounts Are Already Active

Covesting’s new COV denominated account updates are now available for PrimeXBT users. In the future, COV will be added as an asset to yield accounts to provide more flexibility to staking clients. The Covesting roadmap also includes the aforementioned profit-sharing improvements for managers and strategy followers.

Be sure to keep checking the PrimeXBT and Covesting official blog for additional details when they become available.

Risk Disclaimer:

Investing or trading in gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided in no way constitutes a solicitation or an inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, bonds and similar products. Comments and analyzes reflect the opinions of different external and internal analysts at any given time and are subject to change at any time. Furthermore, they cannot constitute a commitment or guarantee on the part of PrimeXBT. Recipient acknowledges and agrees that by its very nature any investment in a financial instrument is random in nature and therefore any investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not in any way affect its future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends consulting a financial professional who has perfect knowledge of the financial and asset situation of the recipient of this message and is able to verify that the mentioned financial products are adapted to the referred situation and the financial objectives pursued.