Here is everything you need to know about the SafeMoon CertiK audit.

SafeMoon rumors

Before we talk about CertiK, we need to make clear the rumors behind SafeMoon.

Launched on March 14 for USD $ 0.00000008, SafeMoon is a DeFi token that promises to reward its holders with sales commissions.

In a few days, the cryptocurrency gained momentum and shot more than 3,000%, ahead of #DogeDay. This overvaluation, in turn, caught the attention of many investors.

The overvaluation of the token also caught the attention of crypto experts, such as Lark Davis and the Wars on Rugs group, who said that SafeMoon is a scam.

Remember just because you make money off of a ponzi does not change the fact that it is a ponzi. #safemoon

— Lark Davis (@TheCryptoLark) April 21, 2021

According to them, the fact that investors do not sell the cryptocurrency ends up holding its current price for longer, generating a manipulated high. In addition, SafeMoon is 100% likely to be a fraud, as its creators hold more than half of the liquidity.

It is worth remembering that on the SafeMoon official website, the cryptocurrency protocol charges its sellers a 10% fee on the sale price. This fee is used to reward individuals who keep the project active. This means that investors are encouraged not to sell the assets after buying them.

The cryptocurrency even came to be compared to the extinct Bitconnect scam. Bitconnect’s scam started in 2016 and promised high returns for those who didn’t sell the cryptocurrency. However, in January 2018, U.S. regulators issued a warning against the company. That’s when things started to get complicated.

Bitconnect was for a brief moment a top 10 #crypto, the people making money did not want to accept it was a ponzi, they made every excuse to justify it, and attacked anyone who stated the obvious.

Then it rug pulled and everyone lost big time. #safemoon is no different.

— Lark Davis (@TheCryptoLark) April 21, 2021

Considering all of this, SafeMoon requested a CertiK audit on April 21st.

What is CertiK?

CertiK is a security blockchain that performs cryptographic audits.

The company is an industry leader by pioneering the use of cutting-edge Formal Verification technology on smart contracts, blockchain protocols, wallets and DApps.

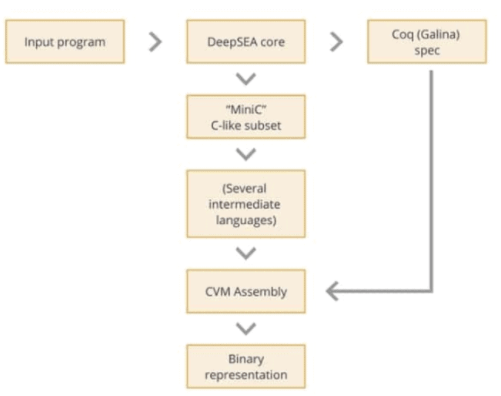

CertiK has a secure programming language on its native blockchain. Through it, users can create their own smart contracts verified on the CertiK blockchain using DeepSEA.

DeepSEA is a compiler and programming language admired for its security.

Notably, the native CertiK tool is developed in conjunction with researchers from leading educational institutions, such as Columbia and Yale University. The toolchain can determine the complex correction properties of smart contracts, thereby increasing the security of the network and the products integrated into it.

It is worth mentioning that although a CertiK audit can reveal exploits and other security flaws for blockchain equipment, they do not correct any of the problems. The audit simply finds them and offers advice on how to fix security breaches for companies.

In the video below, you can understand how CertiK works:

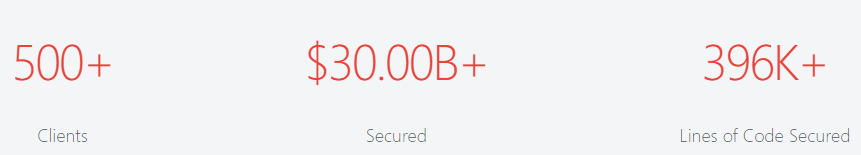

According to CertiK’s official website, the audit has more than 500 customers. Among them, PancakeSwap, 1Inch and Tether.

In addition, more than 396,000 lines of code have been secured, securing more than $ 300 billion to companies.

The audit also has the partnership of the main blockchain players. Among them, Binance, Huobi and International Business Machines (IBM).

Results of the CertiK SafeMoon audit

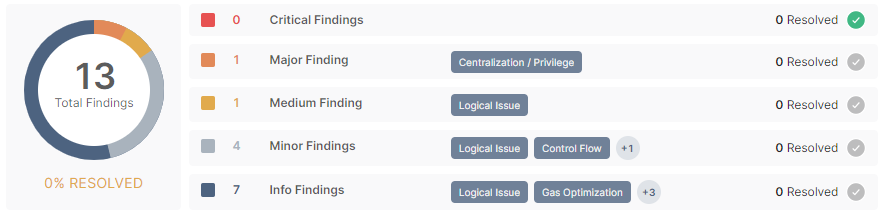

The CertiK SafeMoon audit found a total of 13 problems: one main question, one medium question, four minor questions and seven informational questions.

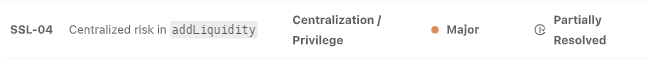

According to the audit, the biggest problem has to do with the risk centralized in the addLiquidity function.

CertiK states that, over time, the owner’s address will accumulate a considerable portion of the liquidity pool tokens. According to the company, if the owner is an external property account (EOA), the entire SafeMoon project could face major consequences.

The company points out that half of the 10% sale rate goes to the liquidity pool in the state where things are. In addition, as SafeMoon currently accumulates a portion of the liquidity pool, this means that the owner’s address would be collecting part of the lost tokens.

To address this issue, the audit recommends restricting the management of liquidity pool tokens, in addition to improving privileges and functions to make them more decentralized.

Finally, CertiK claims that SafeMoon could introduce a DAO / governance / voting module to make the process more transparent and less risky.

In response to the audit, SafeMoon states that its foundation structure is what makes the project unique in relation to the others. More specifically, SafeMoon says it is less likely to hit the carpet because of the legal responsibilities that its founding team faces.

In addition, SafeMoon says that its objectives and intentions as to why they maintain custody of the contract are publicly expressed.

“The roles allow additional control for the SafeMoon team to make continuous strategic moves in relation to the long-term growth of the community and the project,” says SafeMoon.