The sharp pullback and the amount of time Bitcoin has spent looking weak has many traders worried that the current bull market has come to an end and that we are entering a bear market.

While the recent short-term price trajectory looks bearish, two historical data tracing Bitcoin’s movement in past bull runs are suggesting that the current bull market is far from over.

These two pieces of data are the Mining Fee Reward Schedule and the Historical ROI Cycle.

The mining fee reward rate suggests that the bull market has not passed

After each Bitcoin is halved, the block rewards decrease and therefore the mining fee amount is rewarded as a proportion of all network revenue increases. Analyzing the Bitcoin mining rate reward rate trajectory pattern can help us determine which stage of the halving cycle we are. In the diagram below, we can see that the ratio generally rises in 4 unique bursts, each creating a higher high, with the price at the top of the Bitcoin cycle coinciding with the fourth increase in the fee reward rate and subsequently dropping dramatically as Bitcoin moves into a bear market. The current halving cycle has only seen 2 similar peaks, meaning that we are missing the other 2 peaks and may still see another 2 peaks in the fee reward rate before the price starts moving into a bear market. This might suggest that the current bull market in BTC may not be over as we have not yet seen the final 2 higher peaks in the mining reward rate.

This phenomenon has a logical explanation when referring to the current situation in relation to BTC mining.

The current mining reward rate has dropped due to the large drop in hashrate caused by the large migration of mining out of China. While it seems bearish, this drop in the fee reward rate seems to be an integral part of its swings witnessed in the 2017 bullish cycle as well. In the 2017 cycle, the rate reward rate dropped dramatically with each explosion, only to fully recover and rise in the next explosion. So while the news of China’s mining exodus sounds like a unique development, its impact statistically is not out of the ordinary. Earlier bull cycles witnessed similar downfalls but recovered soon afterwards.

For our current situation, the drop in hashrate rate and fee reward will also definitely recover as more miners move in and restart their machines, which experts estimate should take about 6 months. The current lull is therefore temporary and the Bitcoin hashrate is recovering as we speak, and will be back to what it was at the end of this year (assuming miners take up to 6 months to migrate according to experts). This may be when the last two bursts in the rate reward rate start to happen.

In other words, despite many allegations that China ended this year’s bull run with a mining ban, historical data is proving otherwise.

With 2 peaks still close in the current bull run, this mining exodus in China could simply be putting it into a period of temporary consolidation, thus extending the duration of the bull run, rather than ending it.

Another interesting metric seems to agree with my theory that the bull run is just being prolonged.

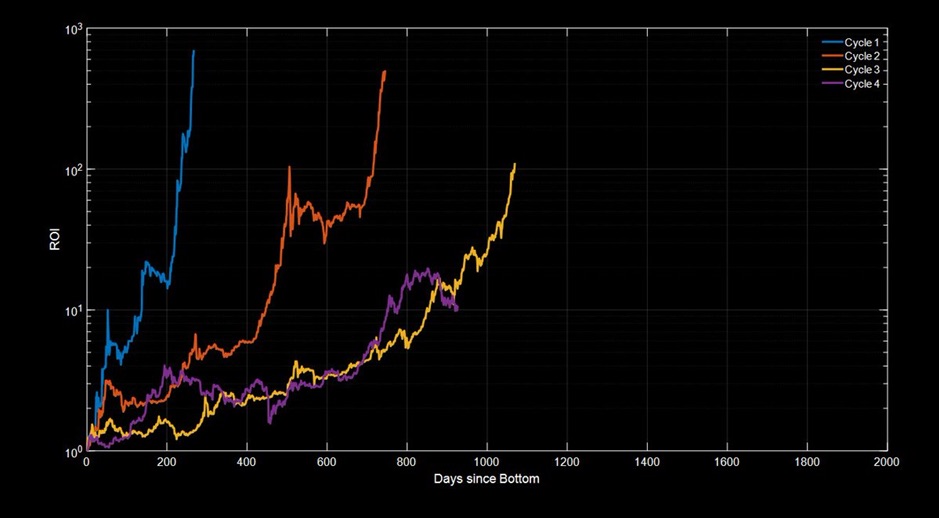

The historical ROI cycle shows that we are just in the middle of the cycle

According to Bitcoin’s historical ROI, the current bullish cycle, if it has already ended, will be the shortest with the lowest ROI and peaked earlier than it should, as shown by the purple graph below.

If we use the historical curvature of the 3 previous bull races as a guide, each new bull cycle should last longer, taking a greater number of days to reach each new peak. However, the purple graph representing the current bull run has changed too fast and peaked too early with reference to Cycle 3 of 2017 (in yellow) if it really was the peak of the cycle. So it appears that the current BTC price pullback is just moving it back into place, prolonging the number of days it takes until it reaches its next parabolic upward move, likely near the 1200-day mark based on my extrapolation.

If this pattern really works, this bull cycle should have at least another 300 days before it peaks in the middle of next year, and the current downturn is nothing more than a consolidation that happened every cycle. This period of consolidation fits perfectly with China’s mining exodus, which is extending the duration of the current bull run, forcing the market to consolidate in about 6 months, which experts believe is the time it takes for miners affected people to connect their machines back and let the hashrate recover to the previous level. Only when the hashrate recovers will we be able to see the third increase in the mining rate reward rate and continue the high run.

The historical data and unfolding events seem to fit very well to suggest that the market may consolidate around 6 months (it’s been 3 months already) before the Bitcoin price goes back above $64,000 and up again. If 2 more spikes in the mining fee reward rate are occurring, and following the historical ROI trajectory, the price per Bitcoin could reach around $150,000 next year.

About Kim Chua, Market Analyst at PrimeXBT:

Kim Chua is an institutional trading specialist with a successful track record that spans major banks including Deutsche Bank, China Merchants Bank and others. Over time, Chua launched a hedge fund that consistently delivered triple-digit returns for seven years. Chua is also an educator at heart who developed her own trading curriculum to pass her knowledge on to a new generation of analysts. Kim Chua closely follows the traditional and cryptocurrency markets and is eager to find future investment and trading opportunities as the two very different asset classes begin to converge.

Kim Chua is an institutional trading specialist with a successful track record that spans major banks including Deutsche Bank, China Merchants Bank and others. Over time, Chua launched a hedge fund that consistently delivered triple-digit returns for seven years. Chua is also an educator at heart who developed her own trading curriculum to pass her knowledge on to a new generation of analysts. Kim Chua closely follows the traditional and cryptocurrency markets and is eager to find future investment and trading opportunities as the two very different asset classes begin to converge.