Cryptocurrency project Spore Finance shoots more than 500% in 24 hours. What is Spore Finance, where can you buy and sell it and is it for real?

What is Spore Finance?

Spore Finance – or RFI – is an Ethereum token that calls itself the finance reflector. The token was launched on March 18, 2021 and aims to build an ecosystem of reflected tokens (NFT) generated by algorithms.

Spore Finance identifies itself with the mushroom spore-like spread and intends to create a forecast market for the future NFT.

In addition, according to its developers, the digital token was designed to provide revenue within the DeFi environment. Transaction fees are charged and then passed on to existing RFI holders. This means that by holding the token, you receive fees for any transaction in it.

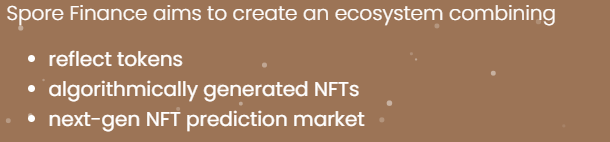

According to the Spore Finance website, 6% of your reward will be burned, as 3% will be redistributed to the holder and the other 3% will be burned as a reward. See the image below:

Spore Finance: Pros and cons of RFI

An advantage of RFI is its automation. However, the bad news is that investors will be relying on a very undefined central token. In addition, contracts are complicated, easily hacked and often have bugs.

Developers working on RFI contracts take a rather superficial approach to the realities of the economy. With Spore Finance, 3% of transactions are burned forever.

The token resembles other passive betting reward coins in the market, such as SafeMoon. It is possible to get fast ROI if investors bet early enough. However, these tokens tend to be short-term opportunities.

In addition, it is worth remembering that large percentages of burning do not encourage much.

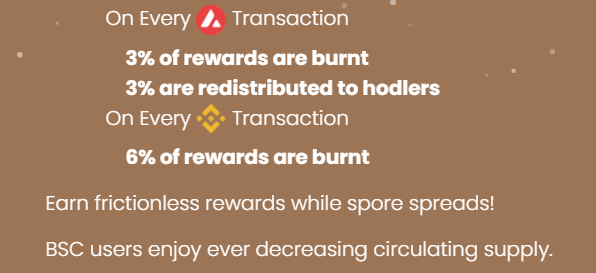

Currently, the percentage of burned tokens is 50.30%. In the image below, it is possible to check Spore Finance’s “tokeneconomics”.

According to experts, leaning towards NFTs does not tend to be a sustainable project in the long run. However, with Spore Finance, investors will be betting on the future of non-fungible tokens.

“Safe Moon scam”

SafeMoon is a DeFi token that, until then, promises to reward its holders with sales commissions.

The cryptocurrency was launched on March 14 for $ 0.00000008. Since then, it has gained popularity and grown by more than 3,000%. This overvaluation, in turn, caught the attention of several investors.

In just 30 days, SafeMoon has reached a frightening capitalization of USD $ 6 billion in market capitalization. In addition, in 7 days, the asset price reached a record USD $ 0.00000919 on April 20.

Currently, the asset price is USD $ 0.000003915 and the market capitalization is USD $ 2,299,555,095.89.

According to SafeMoon’s official website, the cryptocurrency protocol charges its sellers a 10% fee on the sale price. This fee is used to reward individuals who keep the project active.

This means that investors are encouraged not to sell the assets after buying them. The reason for this is that, supposedly, they will benefit from the sale rates of whoever decides to give up the digital asset.

With this strategy, SafeMoon reached more than one million investors worldwide and more than 300 thousand followers on Twitter, although it is listed in some crypto brokers.

Despite the name, which aims to provide the idea of security, SafeMoon has been pointed out by crypto experts as a fraud and not a safe choice.

Should you invest in Spore Finance?

In the opinion of experts, Spore Finance is following a very recent script, since the token was launched in March and continues with an air launch program and incentives. In addition, the development of the second layer blockchain has been completed and SPORE is currently pursuing partnerships.

However, like SafeMoon, not the whole project is worth investing in. If NFTs become a basic element of long-term encryption, the token may have potential. But, it can take a long time to reach a significant price, even if it is well linked to the crypto industry.

At its current stage of development, the token does not yet have a price or market capitalization defined in Cointraker. In addition, its liquidity is not surprising and most transactions tend to be very small.

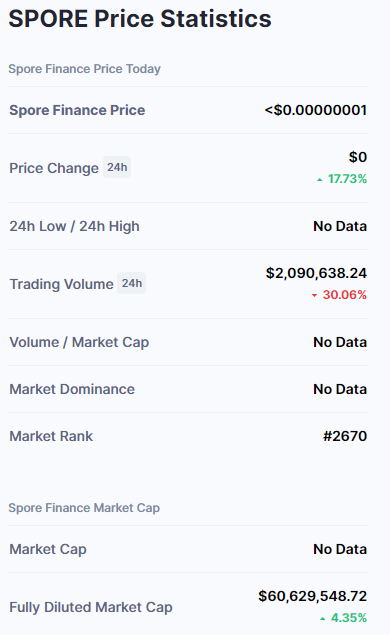

At CoinMarketCap, SPORE also has no attractive values. Its market price is less than USD $0.00000001 and has no defined capitalization and market dominance. See the images below:

Experts also warn that there is potential for some gains with SPORE. However, this will really depend on how many similar projects the investor will be involved in and the currency consolidation. Keep in mind that investing in crypto and other assets involves risks that should be taken into consideration by each investor.