There is no denying that Decentralized Finance (DeFi) has been growing considerably in the crypto market. While in 2017 the competition was to find out the top 10 cryptocurrency to invest, in 2021 everyone wants their tokens to be DeFi.

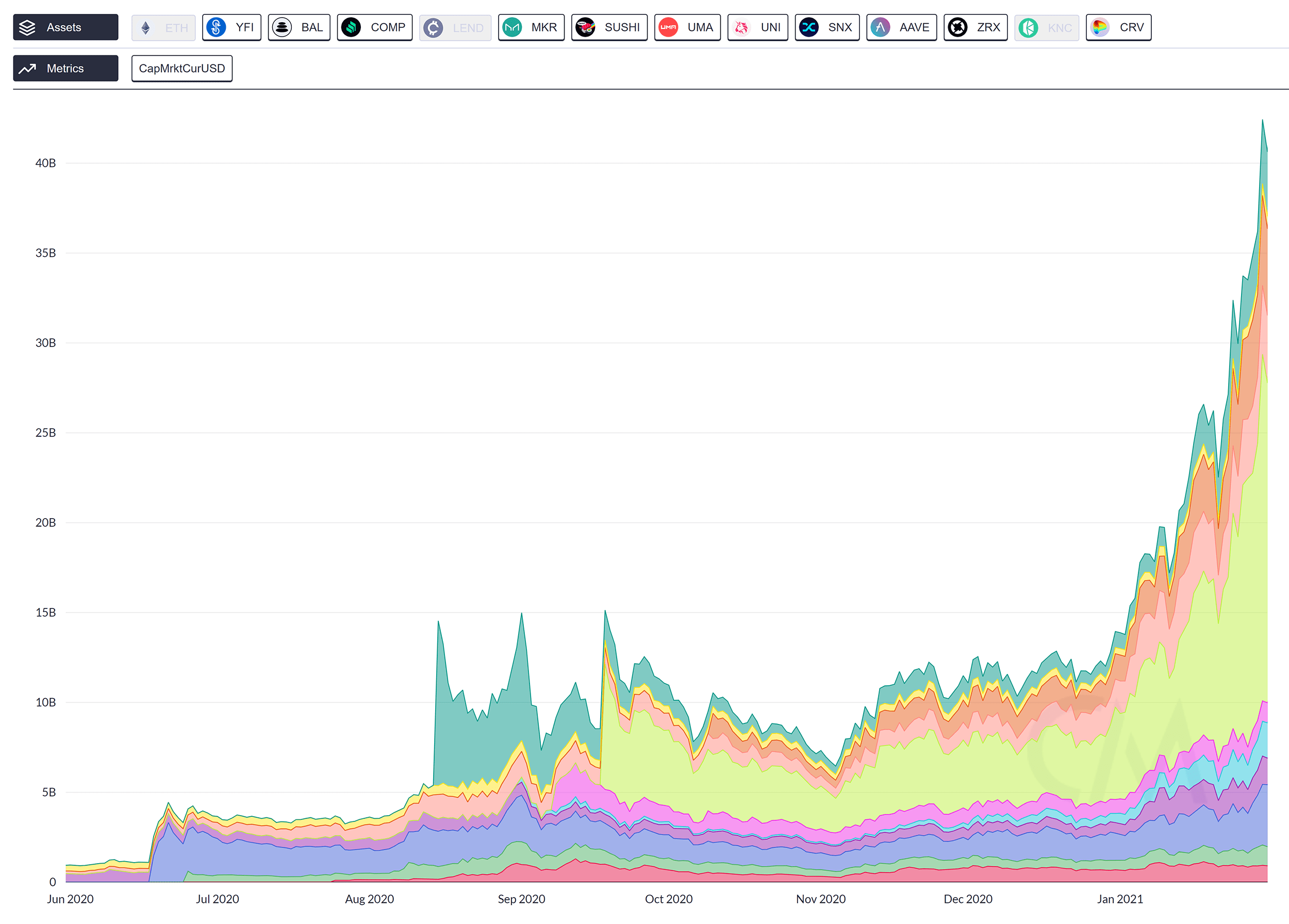

A study published on Yahoo Finance reveals that the Total Blocked Value (TLV) – a measure of DeFi transaction – grew by 14 times in 2020. As of 2021, the TLV more than doubled to an amount of US $ 37.67 billion, according to data from DeFi Pulse.

If you want to know what are the top 5 DeFi trends for 2021, be sure to read on!

What do the experts consider to be “DeFi”?

Before we list the top 5 DeFi trends for 2021, we need to make clear what the experts in the crypto market consider to be Decentralized Finance.

According to these professionals, some requirements must be met for protocols and their assets to be considered DeFi.

1. Financial use: The use of DeFi must be clearly aimed at financial applications. Examples are: loans, brokerage, asset management and issuance of synthetic assets and derivatives.

2. Open code: Anyone can use DeFi or develop it from other projects without having to ask permission from third parties.

3. Alias: It is not necessary for people to reveal their identities to use DeFi protocols.

4. Non custodial: DeFi does not depend on external facilitators.

5. Decentralized governance: Administrative decisions and privileges can be made by more than one entity. In addition, there is no credible way to remove them.

Top 5 DeFi Trends for 2021

Read on and discover the main trends in the broad DeFi market.

1. Entry of traditional financial products

Among the main DeFi trends, the entry of traditional financial products into the decentralized finance market stands out.

It is estimated that in traditional markets the total value of derivatives is 10 times greater than the global GDP, according to data from Investopedia.

Generally, these derivatives tend to lower the value of the regular financial markets. On the other hand, the DeFi market grows every day and is already a trend for many crypto investors.

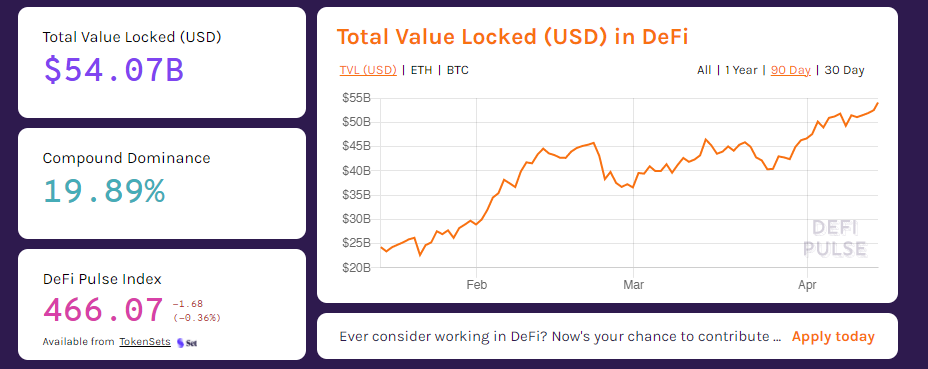

According to DeFi Pulse, the current value of DeFi derivatives is USD$54.07 billion and it represents a compound dominance of 19.89%. In 2020, the TLV of the DeFi derivatives market was USD$939.507 million, that is, in one year this market grew by more than 50 times.

Synthetix

Among the biggest players in the DeFi market, Synthetix stands out. The asset represents approximately 83.73% of the total DeFi derivatives market.

Creator of “Synths”, or synthetic assets, the network basically created an ecosystem where users can expose themselves to assets and commodities without the need for intermediaries.

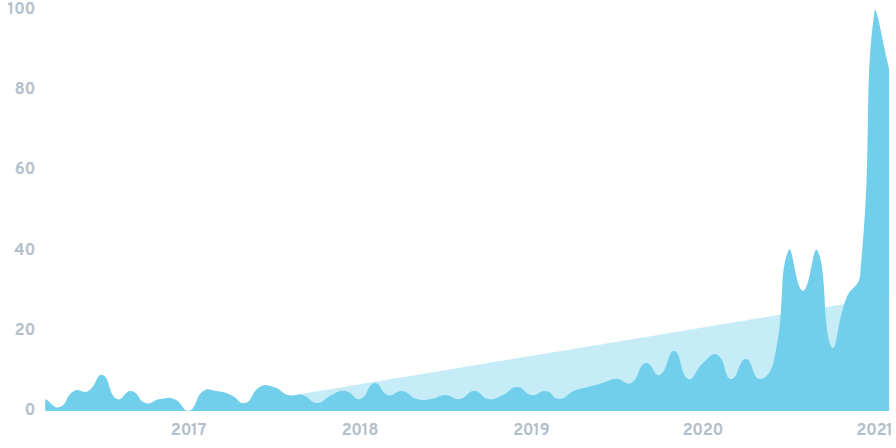

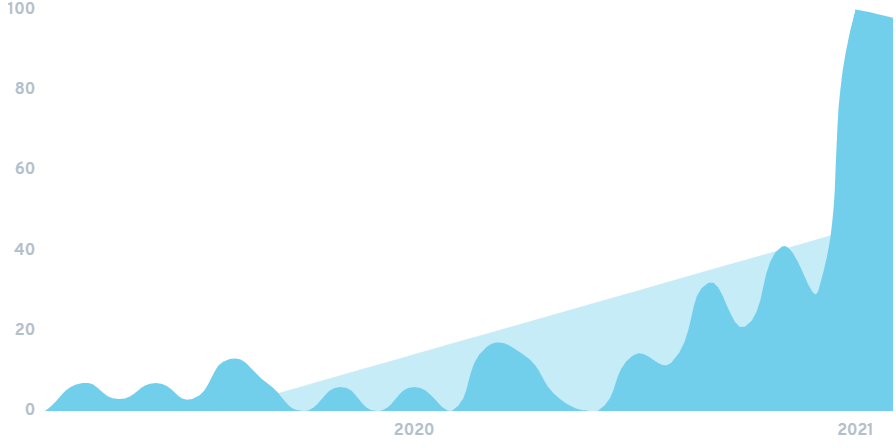

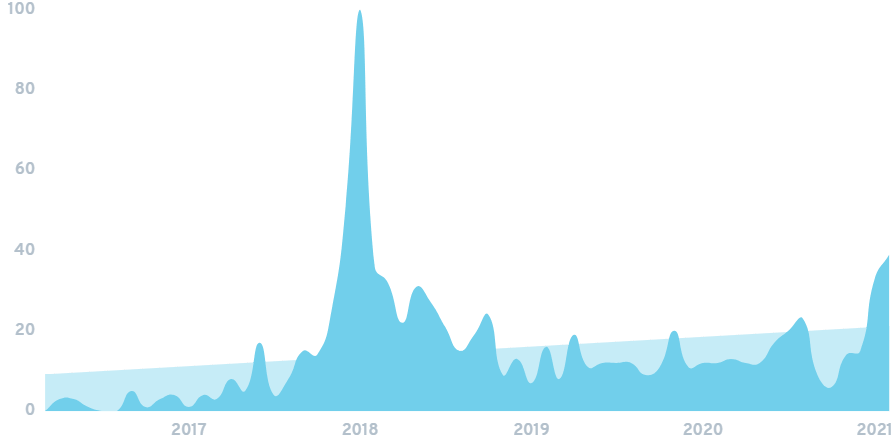

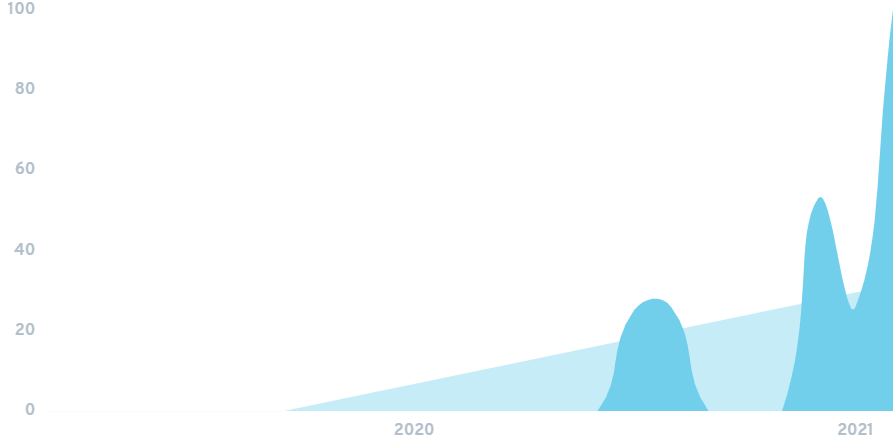

Over the past five years, interest in Synthetix has grown by 2733%, as shown in the graph below.

Wrapped Bitcoin

Another way to use derivatives to increase the efficiency of the crypto market is through Wrapped Bitcoin (WBTC).

The network aims to create Bitcoin derivatives based on Ethereum. In this way, Bitcoin investors will be able to use the derivative version of BTC to conduct transactions such as bets, loans or farm proceeds on the Ethereum blockchain.

Currently, the WBTC represents about 1% of the total bitcoin supply. However, projections estimate that the WBTC could jump to 5% by the end of the year, making it possible to carry out all types of transactions between platforms.

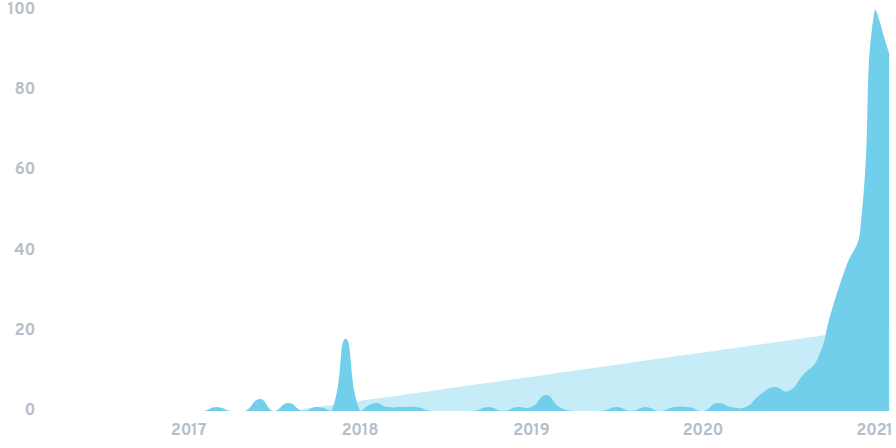

In the past five years, interest in WBTC has increased by 7500%.

Wrapped Ethereum

Wrapped Ethereum (WETH) is an ERC-20 token standard created shortly after the creation of Ethereum (ETH). WETH allows ETH investors to easily convert the cryptocurrency to an ERC-20 token.

In September 2020, more than 5% of ETH had been converted to WETH. And by the end of 2020, more than 5.5 million WETH were created.

Hegic

Traditional financial products are also gaining visibility in the crypto market.

Hegic is the market’s leading asset for crypto-based trades. The platform allows users to enter into chain contracts for ETH and WBTC. In this way, holders of cryptocurrency can mitigate risks and short sell certain assets.

Data released by Hegic itself reveals that the platform wants to reach around US $ 9.2 billion in total daily trading volume of the ETH and BTC options. As of December 2020, ETH’s daily options average was between USD$50 and USD$120 million. BTC’s options were USD$ 300 to USD$ 800 million per day.

In the past 2 years, interest in Hegic has increased by 970%.

Loans in instalments

Instalment loans are other forms of traditional financial innovation that enter the crypto ecosystem. This type of loan allows lenders to finance more volatile and risky loans, acquiring a loan portfolio and segregating the results to groups of investors according to their interest in risk.

In addition, instalment loans have played an increasingly important role in the crypto world, as the inherent volatility of crypto assets makes a reliable fixed income almost impossible to obtain unless some kind of instalment loan is created.

BarnBridge and Saffron Finance are pioneers in the crypto market for this sort of loan.

Increase in DeFi Insurance

The increase in DeFi Insurance is directly related to the growth of DeFi and DeFi derivative products.

DeFi Insurance is similar to the traditional insurance. However, in a decentralized way, DeFi Insurance combines DeFi users who seek to earn income with those who seek to reduce risks.

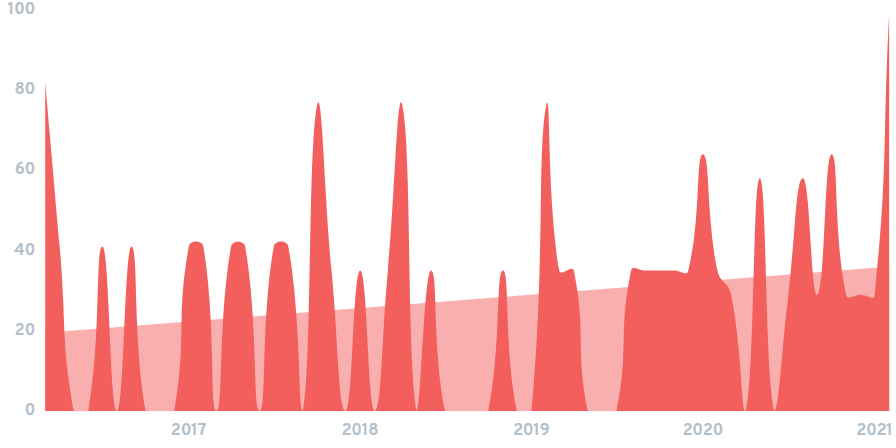

In the last 2 years, interest in Insurance Defi shot 416%, as shown in the chart below.

2. Monetization of blockchain games

According to Nasdaq, there are more than 2 billion players in the world. These players, usually spend more than USD$159 billion a year. In addition, it is estimated that in 2025 this expenditure will jump to approximately USD$256 billion.

With more and more individuals dedicated to the entertainment world – mainly due to Covid-19 – both players and developers are looking for ways to further monetize the gaming industry.

One way found for such monetization is through blockchain games, such as video games, that are not run on a central server. Thus, from completing tasks in games, players “mine” tokens.

However, DeFi protocols are necessary so that the tokens obtained within the games can be transferred. In addition, it is very likely that game-based cryptocurrency owners will want to achieve positive ROI (Return on Investment).

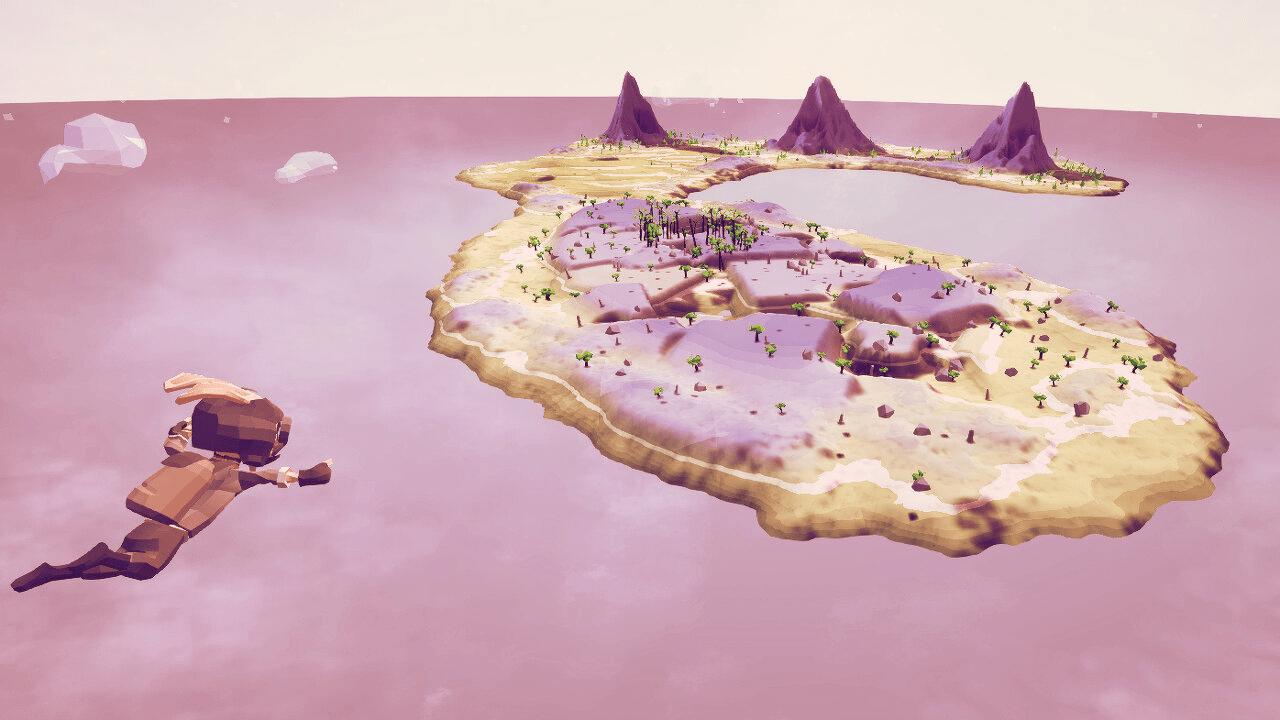

HashCraft

In 2018, Coindesk surveys concluded that 62% of players and 82% of developers would be interested in digital assets transferable between games. From there, in 2019, Ubisoft created HashCraft, the first blockchain video game.

Currently, several blockchain video game titles have been announced in the gamer market.

3. Cross-chain technology vs. scalability issues

Another trend worth mentioning is the use of cross-chain technology (or cross blockchain technology) in an attempt to solve scalability problems.

The rapid growth of the DeFi ecosystem has triggered an increase in transaction values. To solve the problem, many projects in the crypto space are beginning to offer cross-chain functionality.

Cross-chain technology aims to allow transactions and smart contracts to migrate between chains. The goal is for DeFi platforms to scale more easily than on the Ethereum network.

Polkadot

Polkadot is the most successful innovator to allow cross-blockchain transfers of data, and other assets.

The network also allows users to create custom blockchains. In this way, transactions are more efficient and spread across parallel blockchains.

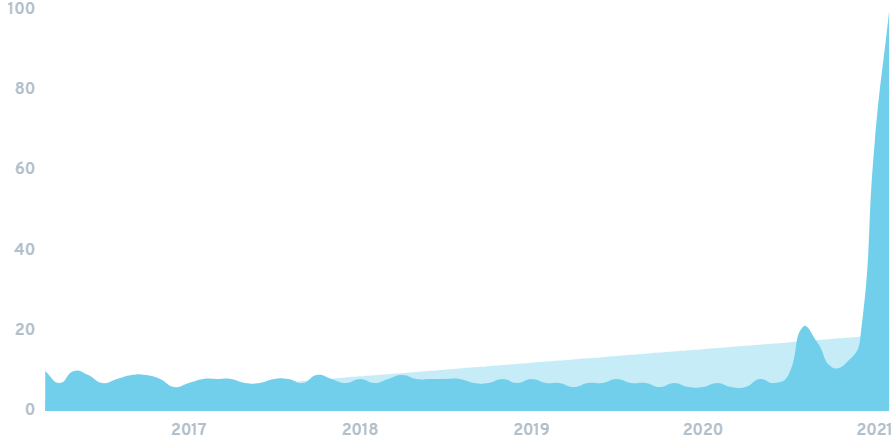

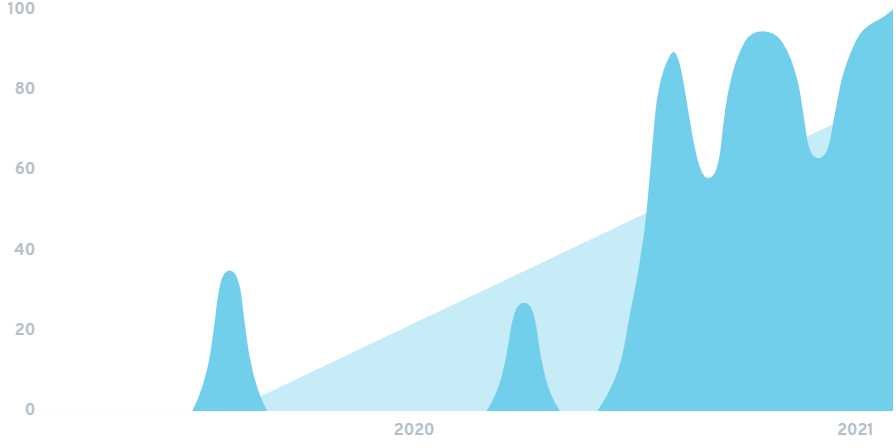

In the chart below, it is possible to see that searches for Polkadot have increased by 900% in the last 5 years.

4. DEX and AMM drive DeFi growth

Another DeFi Trends are DEX and AMM.

One of the biggest problems in the DeFi ecosystem is finding the best way to combine decentralization with efficiency.

Centralized currency exchanges allow for efficient transactions. But, they fall short when it comes to decentralization. This is where decentralized exchanges (DEXs) come in.

Through DEXs, crypto users are able to negotiate without the need for intermediaries.

This “decentralized exchange rate” has gained enormous visibility in recent years, as can be seen in the graph below.

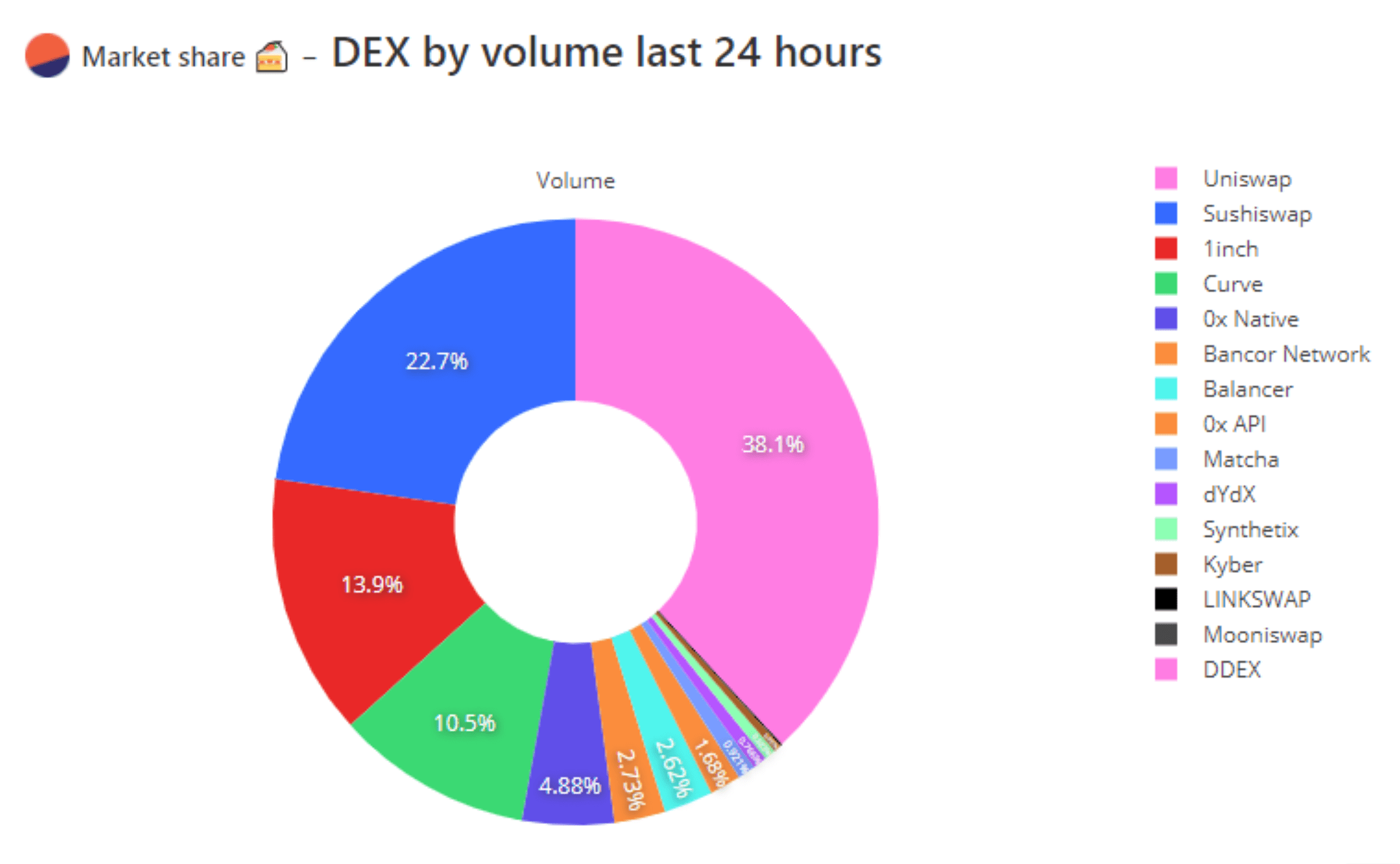

The biggest DEX asset on the market is Uniswap. Together with Sushiswap, the second largest exchange, it represents about 64% of the total volume of DEX trades.

Currently, DEX’s volume has already exceeded the amount of US $ 120 billion. As the value increases, DEXs are forced to find ways to make their exchanges more efficiently.

The main way found for this was through the use of automated market makers (AMMs).

AMMs are used to provide more liquidity to DEX. Like most of the DeFi ecosystem, this liquidity involves staking. Holders of crypto assets lend them to the liquidity pool in exchange for interest. The AMM then charges DEX transaction fees, which are paid by traders on the exchange. Finally, these fees are used to pay interest to the true owners of the assets in the liquidity wallet.

In the graph below, it is possible to see that, in the last 2 years, searches for AMMs increased by 537%.

Some experts believe that this trading method has greatly improved DEX’s liquidity. In November 2020 it was reported that 93% of all DEXs now uses AMMs.

5. Governance tokens gain greater importance

The last top 5 DeFi Trends in our list is the increased use of governance tokens.

Governance token is the name assigned to DeFi platforms that also offer their own tokens. In the past 2 years, these tokens have grown by 99 times.

Governance tokens are intended to provide token holders with voting rights in relation to the underlying DeFi protocols. In other words, token holders vote on initiatives, and the value of their tokens generally increases when the DeFi protocol gains more users or increases its TVL.

Between 2020 and 2021, the collective market capitalization of governance tokens grew to more than $ 50 million. It is estimated that this figure will grow even more in 2021.